Total percentage of taxes taken out of paycheck

These are contributions that you make before any taxes are withheld from your paycheck. For example if your gross pay is 4000 and your total tax payments are 1250 then your percentage tax is 1250 divided by 4000 or 3125 percent.

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

You pay the tax on only the first 147000 of your.

. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. Amount taken out of an average biweekly paycheck. The other federal taxes do have standard amounts they are as follows.

For example if your gross pay is 4000 and your total tax payments are 1250 then your percentage tax is 1250 divided by 4000 or 3125 percent. Yearly after all the taxes are paid for the take-home paycheck is 21597 in total. Colorado income tax rate.

The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. Colorado Paycheck Quick Facts. For a single filer the first 9875 you earn is taxed at 10.

Oklahoma Paycheck Quick Facts. Multiply the result by 100 to convert it to a percentage. The federal government requires that you pay 62 percent of your gross pay for FICA taxes and one-half of your Medicare taxes.

Oklahoma income tax rate. The employer portion is 15 percent and the. The current rate for.

Census Bureau Number of cities that have local income taxes. 62 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 62. This means the total percentage for tax.

Therefore the total amount of taxes paid annually would be 4403. Census Bureau Number of cities that have local income taxes. This is divided up so that both employer and employee pay 62 each.

The federal withholding tax has seven rates for 2021. How do I calculate the percentage of taxes taken out of my paycheck. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15.

Paycheck Tax Calculator Social Security tax and Medicare tax are two federal taxes deducted from your paycheck. How do I calculate the percentage of taxes taken out of my paycheck. Total income taxes paid.

10 12 22 24 32 35 and 37. Together these are called FICA taxes and your. These amounts are paid by both employees and employers.

If youd like to calculate the overall percentage of tax deducted from your paycheck first add up the dollar. FICA taxes consist of Social Security and Medicare taxes. Social Security tax 124.

Also Know how much in taxes is taken out of my paycheck. Add up all your tax payments and divide this amount by your gross total pay to determine the percentage of tax you pay. For each pay period your employer will withhold 62 of your earnings for Social Security taxes and 145 of your earnings for Medicare taxes.

What percentage is deducted from paycheck. Federal income taxes are paid in tiers. Add up all your tax payments and divide this amount by your gross pay to determine the percentage of tax you pay.

For 2022 employees will pay 62 in Social Security on the. If youd like to calculate the overall percentage of tax deducted from your paycheck first add up the dollar amounts of each tax withheld. From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches.

The Social Security tax is 62 percent of your total pay. The federal withholding tax rate an employee owes depends on their income level and filing. Total income taxes paid.

Divide the total of your tax deductions by your total or gross pay.

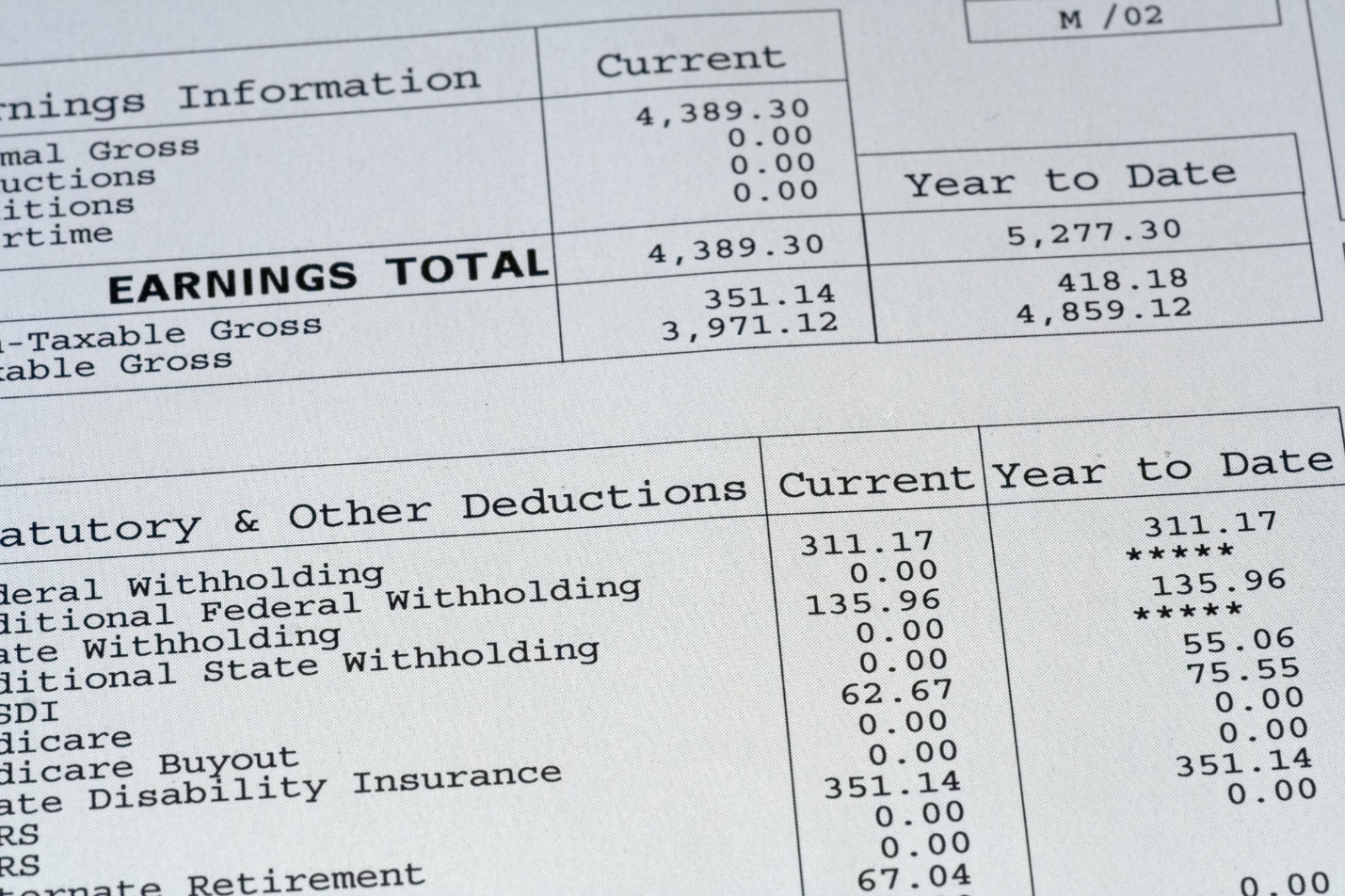

Understanding Your Paycheck

Payroll Tax What It Is How To Calculate It Bench Accounting

Tax Information Career Training Usa Interexchange

Paycheck Taxes Federal State Local Withholding H R Block

Irs New Tax Withholding Tables

Decoding Your Paystub In 2022 Entertainment Partners

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Massachusetts Paycheck Calculator Smartasset

Check Your Paycheck News Congressman Daniel Webster

2022 Federal State Payroll Tax Rates For Employers

Understanding Your Paycheck Credit Com

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Paycheck Calculator Online For Per Pay Period Create W 4

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Different Types Of Payroll Deductions Gusto

Az Big Media How To Read Your Paycheck Stub In 4 Simple Steps Az Big Media